unrealized capital gains tax meaning

Unrealized gains are not taxed until you sell the investment and the gain is realized. What is an unrealized capital gain.

First much of their income is taxed at preferred rates.

. Unrealized Gains Current snapshot in time. Not able to change. If your capital gains are the total of your gains from stock transactions plus your box 2a from 1099-DIV everything is correct.

Realized Gains Actual locked-in gains. What this means is that someone who owns stock or property that increases in value does not pay tax on that. They are realized gains from within a mutual fund or company in which you have invested.

It is the theoretical profit existent on paper. That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder still owns the security. Unrealized Capital Gain means with respect to any Reference Obligation if the Current Price of such Reference Obligation is greater than the Initial Price in relation to such Reference Obligation then a such Current Price minus such Initial Price multiplied by b the Reference Amount of such Reference Obligation.

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. Our estimate assumes that realizations are 20 percent less responsive to a change in the capital gains tax rate when unrealized gains are taxed at death resulting in a. This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset.

Capital gains distributions are not unrealized gains. If the value drops to 190000 you have a 10000. The tax liability on realized gains depends on your income and how long you owned the investment.

As a result there is the possibility that the paper gain might be erased if the price goes back down. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. In the case of unrealized gains this means investors will likely pay lower capital gains taxes.

Taxing unrealized capital gains at death theoretically increases the revenue-maximizing capital gains tax rate because taxpayers are less likely to hold onto assets until death to avoid the higher rate. This policy allowed the richest Americans to get richer by minimizing their tax obligations. For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain.

What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. FTTs tax financial trades placing another tax on top of existing taxes on capital gains and corporate income. Currently the tax code stipulates that unrealized capital gains are not taxable income.

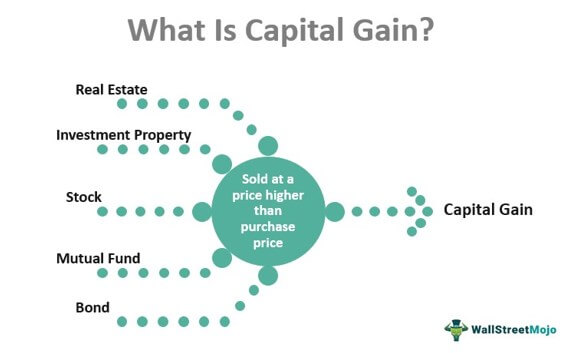

In other words the unrealized gains you have for the tax year arent taxable. A gain on an investment that has not yet been realized. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes frequently resulting in double taxation.

The 16th Amendment would not save such a tax however because it covers only taxes on incomes Income has a legal definition. Currently the tax code stipulates that unrealized capital gains arent taxable income. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that appreciation until the item is sold.

So now that you understand what unrealized gains are how do they impact your life. Since you wont pay taxes on what you lost or something that you havent earned yet the unrealized gains tax doesnt really apply to your federal income tax return until they are realized. And the unrealized losses arent deductible.

The gain is passed to you through Form 1099-DIV and it is taxable income to you. Capital gains taxes create a bias against saving leading to a lower level of national income by encouraging present consumption over investment. Ron Wyden D-Oregon announced on Tuesday that he is working on a mark-to-market system that would tax unrealized capital gains on assets owned by millionaires and billionaires This levy.

An investor is NOT taxed until the investment is exited and a profit is obtained. Unrealized capital gains are increases in value of stock purchases that the purchaser has yet to realize by selling the stock at its new price. An unrealized gain is an increase in your investments value that you have not captured by selling the investment.

In reality it is a tax on wealth. Tax pyramiding obscures the impact of taxes on taxpayers while creating situations. Households worth more than 100 million as.

In the stock trading world a realized gain or loss is the actual gainloss that occurs as a result of closing a position. If an asset has lost value since it was purchased an investor may choose to sell it to offset their gains or they may hold on to it as part of a long-term strategy. Such a tax is really a tax on wealth.

Unrealized gains also referred to as paper gains are NOT taxable. Taxing unrealized capital gains also known as mark-to-market taxation. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

Why is this important. Likewise a tax on unrealized capital gains would be a direct tax. The most likely impact that they will have on.

Realized capital gains occur on the date of exit as this triggers a taxable event whereas unrealized capital gains are simply paper gainslosses. Furthermore even when capital gains are realized they may be taxed at lower rates than other types of income.

How Are Futures And Options Taxed

Strategies For Investments With Big Embedded Capital Gains

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Unrealized Capital Gains Tax What Is It Churchill

How Are Realized Profits Different From Unrealized Or So Called Paper Profits

Capital Gain Meaning Types Calculation Taxation

Capital Gain Formula And Taxes On Unrealized Realized Gains

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Crypto Tax Unrealized Gains Explained Koinly

Capital Gains Tax A Primer Atlanta Tax

Capital Gains Taxes And The Democrats Downsizing The Federal Government

Capital Gain Formula And Taxes On Unrealized Realized Gains

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)